4. Risk vs. reward

ETFs can be a powerful product to add diversification to a portfolio, but like any investment, risk needs to be weighed against reward.

In short

- All investments come with risks, including ETFs

- If the value of your ETF units decrease, you might lose money

- ETF returns can be affected by currency and, in some circumstances, could be hard to sell for the price you want

- They are cost effective, transparent, highly liquid and use diversification to smooth out price swings

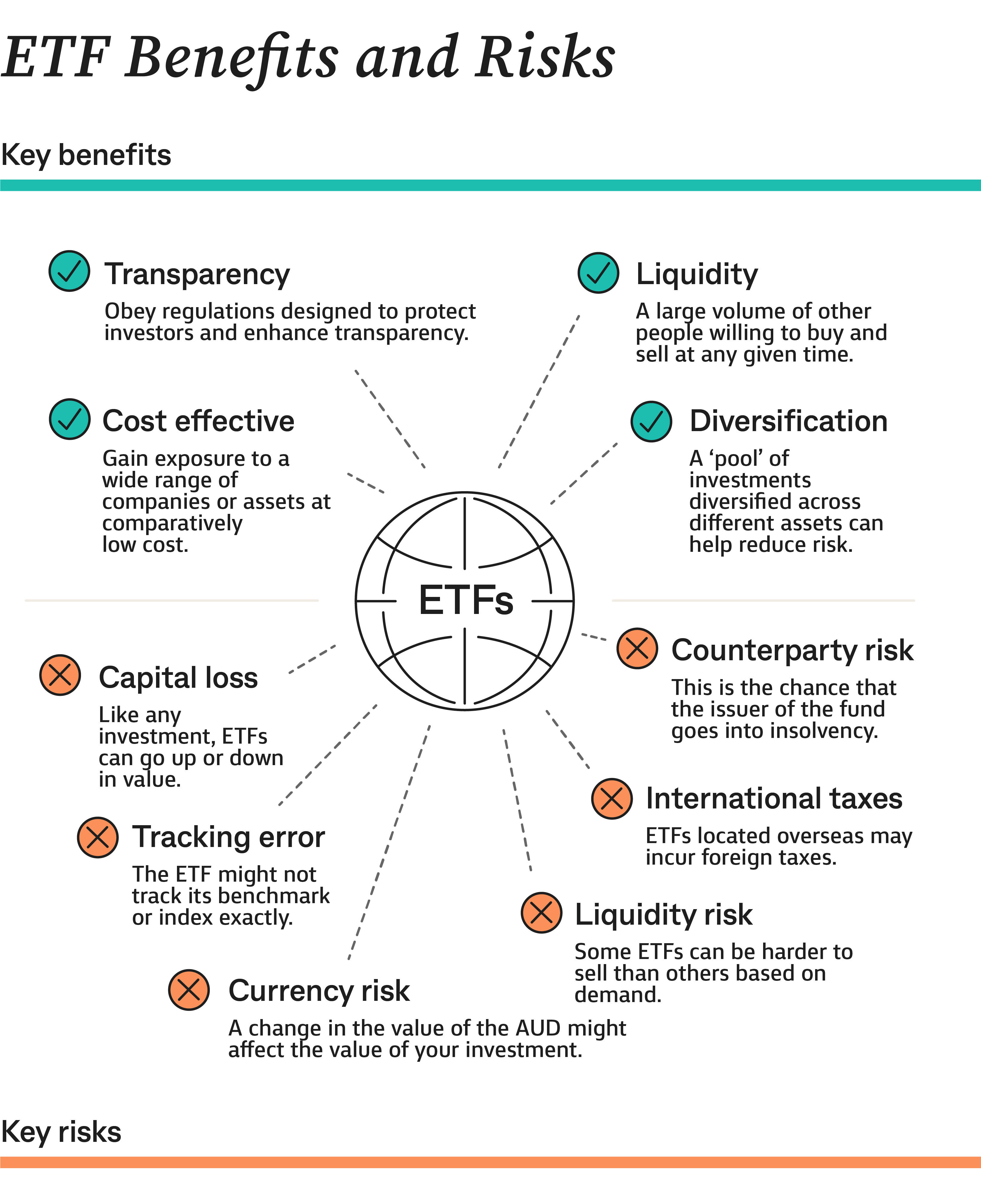

Key benefits

Cost effective: ETFs offer you exposure to a wide range of companies for very little cost. A fund tracking a broad index of shares might invest in over 200 different companies. Buying each share would cost a lot in brokerage fees alone.

Transparency: Trading on a stock exchange means ETFs have to obey a number of rules and laws designed to protect investors and enhance transparency. They’ll need to report their earnings and performance twice a year, release annual reports, and inform the public of any information that could affect their share price.

Liquidity: Trading on exchange also gives ETFs access to a large number of other people willing to buy and sell. This is called liquidity, and it’s a very important factor when choosing an investment. Something with higher liquidity will be easier to sell, particularly in times of market stress.

Diversification: The true power of ETFs lies within their ability to pool investments and buy large amounts of different assets. This is called diversification and it helps smooth out risks, mitigating wild swings in share price.

Key risks

Capital loss: ETFs can go up or down in value, because they're impacted by market changes, economic events, and the companies and industries that they invest in. If you sell your investment when the price is lower than what you paid for it, you'll lose money.

Tracking error: The ETF might not exactly track its benchmark’s returns. It could report lower or higher performance, depending on a range of factors, such as fees or the cost of doing business.

Currency risk: If you buy an ETF that invests in overseas companies or assets, a change in the value of the Australian Dollar might affect the value of your investment. Currency-hedged ETFs can lower this risk for a higher fee.

Liquidity risk: If an ETF invests in assets that could be harder to sell in certain circumstances, you might not be able to sell your units when or at the price you want. But most ETFs have sufficient liquidity.

International taxes: If you buy units in an ETF that's located overseas, you might have to pay foreign taxes.

Counterparty risk: This is the chance the issuer of the fund goes into insolvency.

Previous

Disclaimer

CommSec Learn is intended to provide general information of an educational nature only. The information has been prepared without taking into account your objectives, financial situation or needs. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to their objectives, financial situation or needs, and, if necessary, seek appropriate professional advice. You can view the product Terms and Conditions, Product Disclosure Statement, Best Execution Statement, Financial Services Guide and should consider them before making any decision about these products and services. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. Past performance is not indicative of future performance. Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.