CommSec

CommSec

21 Mar 2023

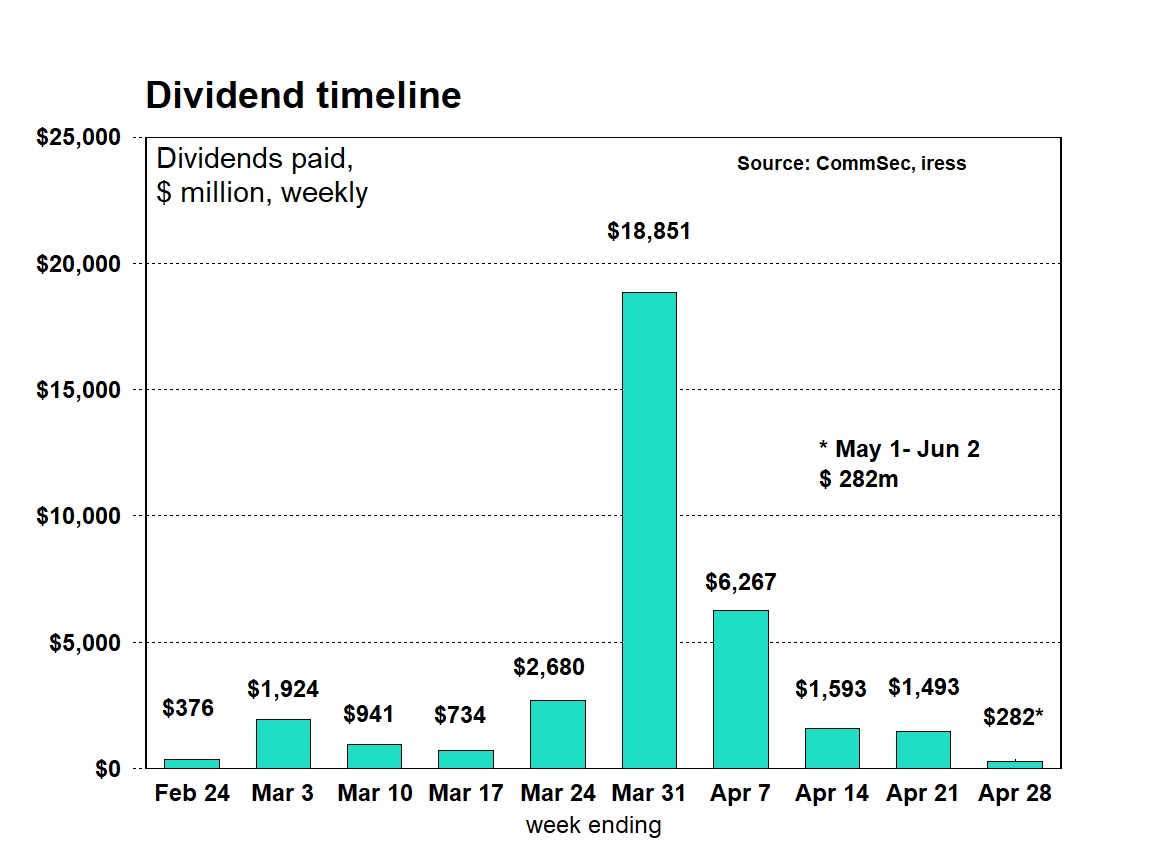

- About $35 billion in dividends will be delivered between February and June 2023.

- That’s down 17 per cent from the $42 billion paid in the August 2022 reporting period.

- Compared to the same time last year, when $36 billion in dividends were paid, it’s about a 3 per cent decline.

Major miners cut dividends, while energy producers lift payouts

Understandably companies have to take current and prospective conditions into account when deciding on what dividends to pay. And that is especially the case of the large iron ore producers in the latest round of earnings. Profits fell sharply over the past year reflecting lower realised iron ore prices. And the outlook suggests lower iron ore prices ahead.

As a result, the big iron ore miners are trimming dividends. It’s worth emphasising that dividends are still historically high, but they are lower than a year ago. In the case of BHP, the upcoming payout of A$6.9 billion is down 34 per cent on a year ago. In Australian dollar terms, Rio Tinto (RIO) will trim payouts by 43 per cent.

Companies and sectors also of note:

- Energy producers are lifting dividends to reflect record gas prices. Woodside Energy (WDS) will lift its final dividend by over 47 per cent (in $A terms). Whitehaven Coal (WHC) will lift payouts by 300 per cent. And Santos (STO) will increase payouts to shareholders by 89 per cent. Still, some STO investors want the company to scale back the growth strategy and provide even more returns to shareholders.

- Financial firms generally are lifting dividends including Commonwealth Bank (CBA, up 20 per cent); Bendigo & Adelaide Bank (BEN, up 9 per cent); Suncorp (SUN, up 43 per cent); QBE (QBE, up 58 per cent)

- Despite passing on higher costs to customers (pricing power), and thus supporting profits, the major supermarkets will lift dividends modestly with Woolworths (WOW, up 18 per cent) and Coles (COL, up 9 per cent).

- Qantas (QAN) chose not to declare a dividend rather choosing the route of a buyback to seek to boost returns for shareholders.

The importance of dividends

Since the Global Financial Crisis the importance of dividends has grown due to the larger role they now play when it comes to total returns.

There are a few reasons for this.

The economy has continued to mature and the “potential” growth rate has eased from around 3.5 per cent to 2.3 per cent.

Many of Australia’s biggest companies operate in mature industries like banks, retailing, health and real estate investment trusts rather than “growth” industries such as technology. So while many companies continue to make money, growth options are more limited.

Over time, Australian companies have to compete with property markets, the security of bank deposits and overseas equities to gain the affection of investors. With share prices seemingly constrained by a range of influences, that puts more onus on companies to offer attractive dividends or to support share prices with buybacks.

Despite the current uncertain environment, more of the listed companies have elected to pay dividends but a higher proportion have reduced payouts compared with a year ago.

Some companies have been paying out more in wages (employing more staff at a higher cost), purchasing new equipment and stocking up on inventories.

Outlook

Investors have the usual choice over the next few weeks. Those investors that still elect to receive dividend payments direct to their bank accounts can choose to spend the extra proceeds, save the proceeds (leave it in the bank) or use the funds in combination with other savings and reinvest into shares or other investments.

With the cost of living rising together with interest rates, some investors may use dividends to maintain their standard of living or meet higher loan repayments.

Of course there always are those investors that see longer-term opportunities – especially given recent volatility – choosing to channel the dividends into sharemarket purchases. The performance of investment returns over time when dividends are included in the calculation is especially emboldening – that old saying that ‘it is time in the market that is important rather than timing the market’.

From an investor perspective, dividend payouts are incredibly important. Regular income payments to investors can cushion portfolios from the bouts of volatility in sharemarkets, preserving capital. And the extra cash put ‘back to work’ in the sharemarket could help stabilise or even support the ASX during the current bout of volatility.

The issues that dominated over the last six months will most likely change in the next six months. Supply-side cost pressures will dissipate. Interest rates could peak and discussion may shift to rate cuts. Tight job markets may ease as economies slow in response to high interest rates.

A possible solution to both high inflation and a volatile sharemarket might very well be for investors to buy dividend-focused shares. ASX-listed companies that pay a regular dividend tend to be more profitable and have transparent growth outlooks.

Overall, Aussie shares still offer attractive income versus bank deposits, bonds and overseas shares with grossed-up dividend yields of around 5.5 per cent. For the S&P/ASX 200 index, the 12-month forward dividend yield is currently a healthy 4.4 per cent, slightly below the recent historical average of 4.6 per cent since 2006.

This compares favourably to dividend yields of 3.6 per cent and 1.8 per cent for European and US shares respectively. And the gap between the ASX 200’s dividend yield and the 10-year Aussie government bond yield is around 100 basis points.

For investors, it is a case of deciding which stocks and sectors will be best positioned to benefit from the changing circumstances.

If you’d like to learn more about dividends, you can read more in our article “Diving into Dividends”.