Additional income may be generated for an investor through a buy-write strategy, even when the investor expects a fall in the share price.

What is a buy-write strategy?

To execute the strategy, the investor will buy (or already hold) the share and simultaneously write or (sell) a call option over the same share. This is also known as a ‘covered call’. Noting that the sold call option is fully covered (1 contract = 100 shares if no adjustment) by the underlying shares the investor holds.

A call option gives the holder (buyer) the right, but not the obligation, to buy the stock at the strike price of the call option on or before the expiry date of the option. In this case, the seller of the call option receives a premium in exchange for taking on the risk of potentially being assigned to sell the underlying shares at the strike price, if the holder of the option choses to exercise their right.

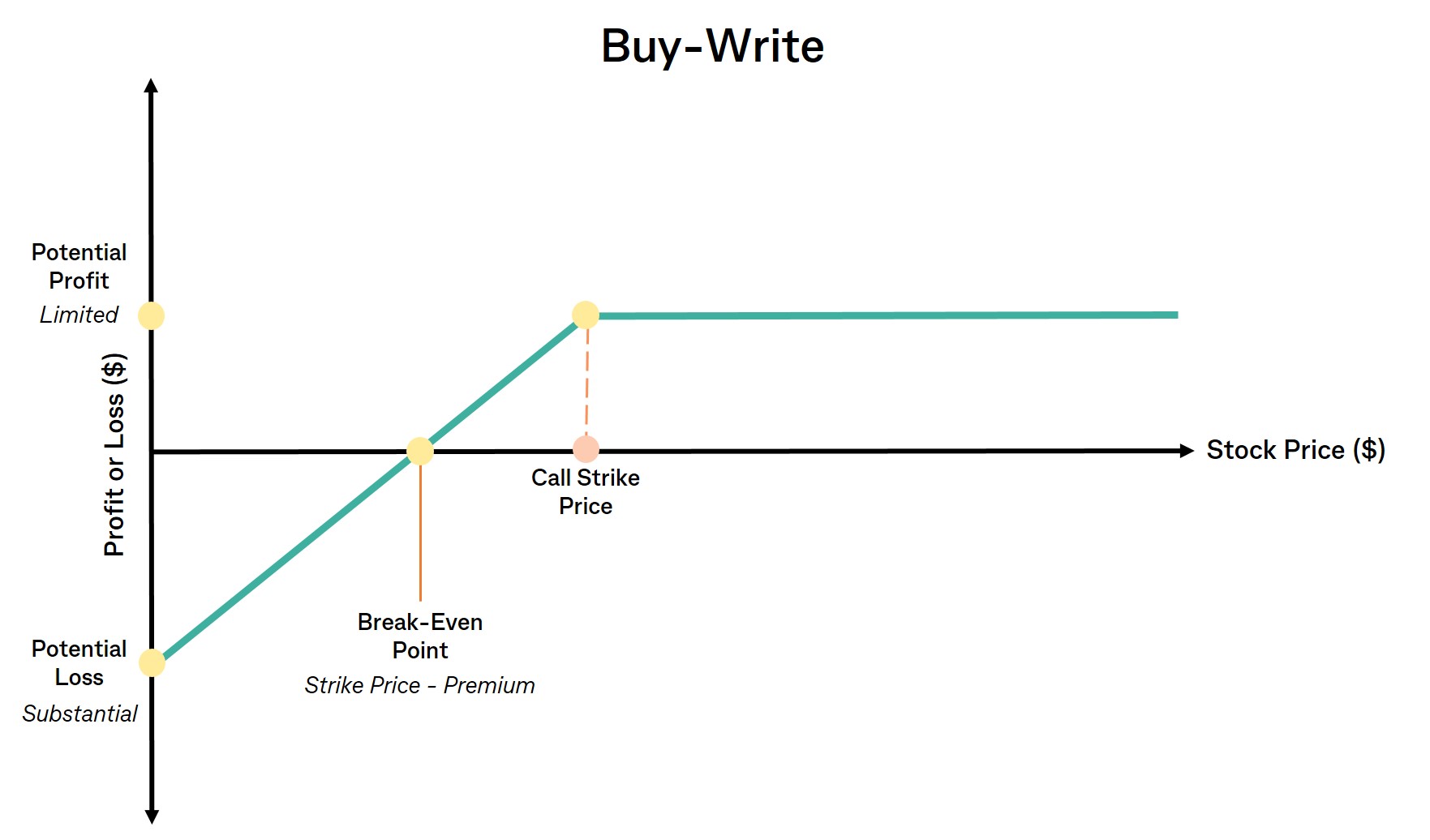

As the investor receives a premium for selling the call option (regardless of if the option is exercised by the buyer or not), it effectively lowers the break-even point1 for the share purchase. This is additional income on top of any dividends received from the underlying shares for the investor.

The buyer of the option has the right to exercise the option regardless of the strike price, however the most likely outcomes for you as the seller are:

- Current share price is above the strike price – option will be exercised and you have the obligation to sell the shares at the strike price

- Current share price equals the strike price – option will not be exercised and you are not required to sell the shares at the strike price

- Current share price is below the strike price – option will not be exercised and you are not required (or able) to sell the shares at the strike price

Please note there is still a risk of assignment even when an option position expires out-of-the-money. The only way to avoid an assignment is by closing the option position.

What to consider

It is typical for an investor to sell a call option with a strike price that is out-of-the-money2 when employing a buy-write strategy. This is where the strike price is above the current market price and is an effective strategy for when the stocks outlook is flat, or slightly elevated, during the lifetime of the strategy. Alternatively, if the investor has a different outlook on the underlying share price they could consider the below strike prices:

- At-the-Money3 – strike price equals current share price where the expectation is for a flat or slightly lower underlying future value

- In-the-Money4 – strike price is below the current share price where the expectation is for the underlying value to fall up to the expiry date

If the investor does not want to carry the risk of having to sell their shares at the strike price prior to the expiry day, also known as an ‘early assignment’, the investor may sell a call option with a European5 expiry type instead of one with an American6 expiry type.

At-the Money and In-the-Money call options are generally written with a European expiry type, as they can only be exercised at expiry.

The European expiry type means an option can only be exercised/assigned on the expiry date of the option. This is particularly beneficial to investors who want to employ a buy-write strategy prior to a share going ex-dividend, but do not want to risk being obligated to sell their shares before the ex-dividend day.

When writing (selling) call options, remember that a stock’s price can rise or fall depending on a number of factors. The stock’s outlook at the time of writing the call may be different to when the option is due to expire.

Using your own capital

When an investor employs a buy-write strategy using their own capital, they are simply utilising shares they own outright or intend to buy with cash, not linked or purchased through a margin loan. The premium earned for selling the call option helps to provide an income stream from the shareholding, even if the underlying share price remains flat or slightly falls.

It is important that the investor is aware that in the event that the underlying share price rises, their potential gains are capped at the strike price of the call option. If the share price does rise above the strike price of the call option the investor may miss out on potential profits beyond that price as there will be a greater chance of assignment.

In the event of an assignment, the investor will receive the premium for both the sold call option and the proceeds for selling the shares at the strike price. This is not a strategy to use if assignments are not wanted. These returns are on top of any dividends the investor may receive from the shareholding.

A key benefit of opening a buy write strategy is that the covered call premium helps to provide a small cushion in the event of a downwards shift in the underlying share price.

Using a margin loan

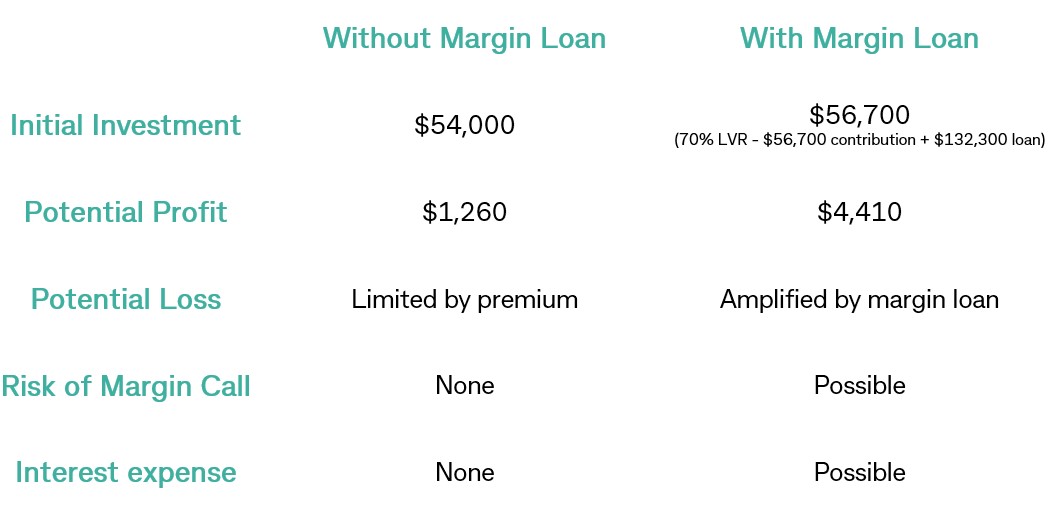

An investor may use a margin loan when employing a buy-write strategy as a tool to amplify their potential returns through leveraging6 available capital.

Using a margin loan facility, the investor has the potential to have a larger shareholding in comparison to using their existing initial capital. Therefore, as well as potentially receiving additional dividends, the premium that the investor will receive for selling the call option will also be larger as they will be able to sell more call option contracts to cover the shareholding. In turn, this will ultimately mean a higher potential income for the investor. Similarly, if the price of the underlying shares rises, the investor has the ability to potentially enjoy higher gains due to the amplified shareholding.

While a margin loan comes with costs such as interest payments, the income from the sold call options can be used to offset some or all of the interest payments from the margin loan.

Similarly to the amplified returns, the investor could face amplified losses if the underlying share price falls, potentially resulting in a loss that exceeds their initial investment. If the value of the underlying shares falls significantly, the investor could face a margin call8. The margin call could require the investor to deposit funds or sell assets to cover the deficit in the margin loan.

You should make sure you understand the benefits and risks of a margin loan before considering whether to incorporate it into your investing strategy. You can generally find out more information in the margin loan provider’s Financial Services Guide and Product Disclosure Statement, or by reading our website.

Gains and Losses

The maximum gain an investor can make with a buy-write strategy is capped at the strike price of the call option. The strategy’s net profit at expiry will be the premium received, plus any gain on the share price (or less share price losses) measured against the strike price of the call option.

When the share price increases above the strike price significantly, the investor will likely be assigned to sell the shares at the strike price. Therefore, the investor will be unable to realise the full gain of the stock.

The maximum loss for the investor is the purchase price of the underlying stock, less the premium received for the covered call. There is always a potential risk that the share price could potentially fall to zero, where only the premium received for the covered call would be retained. Below is an example of how an investor is better off by selling a covered call option.

Gains and losses are amplified when using a margin loan, due to the larger shareholding size (when compared to using your own capital), the risk of margin calls, and margin loan interest payments.

Summary

In summary, whether a buy-write strategy is used in conjunction with a margin loan or not, it offers an investor the opportunity to generate an additional income stream whilst holding on to their shareholding. The decision of whether to use a margin loan will depend on the investor’s preferences, risk tolerance and market outlook.

Hypothetical Example

This example is hypothetical and for illustrative purposes only; actual results may vary significantly. The stock chosen for this example is hypothetical.

An investor has researched company XYZ and is now interested in purchasing a parcel of XYZ shares. Through their research the investor believes that the share price of company XYZ will remain flat for the near future but is certain there will be upside potential in the long-term. The investor wants to generate additional income while the share price of company XYZ is initially steady by using a buy-write strategy.

Using own capital

The investor wishes to establish a position in XYZ and therefore places the below trades simultaneously,

- Purchases 1,000 units of XYZ at $54.00 per share

- Writes 10 contracts of a $56.00 call option Jan-24 expiry for $1.26 per contract

Share price slightly increases to $55.00

- The call option expires out-of-the-money, as the underlying share price is below the strike price of the call option

- The investor retains their 1,000 XYZ shares and the gain from the $1.00 increase in the share price

- The investor keeps the $1,260 premium received for selling the call option

- As the investor retains the XYZ shares, they now have the ability to sell another covered call option on the shareholding

Please note there is still a risk of assignment even when an option position expires out-of-the-money. The only way to avoid an assignment is by closing the option position.

Share price jumps to $62.00

- At the expiry date of the option, the investor is likely to be assigned to sell the underlying shares of XYZ at the strike price of $56.00

- The investor has generated extra income here, as they are selling the XYZ shares at a higher price per share ($56.00) compared to the original purchase price ($54.00)

- The premium received for selling the covered call on the shares is retained

- There is an opportunity cost here as the investor does not benefit from the full price increase of XYZ to $62.00, as the gains on the XYZ shares are capped at the call option strike price of $56.00

Share price declines to $46.00

- The investor’s losses on the share price are offset by the premium received by the sold call option

- The theoretical loss incurred is $8,000 (loss in share value) less $1,260 (premium received) which gives a total loss of $6,740

- The investor is in a better position than if they had not sold the call

- XYZ shares and has the ability to sell another covered call option on the shareholding

With a margin loan

The investor wishes to establish a larger position in XYZ through using a margin loan, and therefore places the below trades simultaneously,

- Purchases 3,500 units of XYZ at $54.00 per share

- Writes 35 contracts of a $56.00 call option Jan-24 expiry for $1.26 per contract

Share price slightly increases to $55.00

- The call option expires out-of-the-money, as the underlying share price is below the strike price of the call option

- The investor retains their 3,500 XYZ shares and the gain from the $1.00 increase in the share price

- The investor keeps the $4,410 premium received for selling the call option and uses these funds to offset the interest payments on the margin loan

- As the investor retains the XYZ shares, they now have the ability to sell another covered call option on the shareholding

Please note if there is still a risk of assignment even when an option position expires out-of-the-money. The only way to avoid an assignment is by closing the option position.

Share price jumps to $62.00

- At the expiry date of the option, the investor is likely to be assigned to sell the underlying shares of XYZ at the strike price of $56.00

- The investor has generated extra income as they are selling the XYZ shares at a higher price per share than the original purchase price

- The premium received for selling the covered call on the shares is also retained by the investor and is used cover interest payments on the margin loan

- There is an opportunity cost here as the investor does not benefit from the full price increase of XYZ to $62.00, as the gains on the XYZ shares are capped at the call option strike price of $56.00

Share price declines to $46.00

- The investor’s losses on the share price are offset by the premium received by the sold call option

- The investor potentially may incur a margin call on the margin loan due to the drop in the XYZ share price. The income from the sold call option may be used to fund some of the margin call.

- The investor is in a better position than if they had not sold the call

- The investor retains the XYZ shares and has the ability to sell another covered call option on the shareholding

1Break-Even Point – For options trading, the point where the market price of an underlying reaches the level at which an investor will not incur a loss. Or for investing, the point where the original cost equals the current market price.

2Out-of-the-Money – For a call option, when the strike price is above the current underlying price. For a put option, when the strike price is below the current underlying price.

3At-of-the-Money – Where the strike price of the option is identical to the current price of the underlying asset.

4In-the-Money – For a call option, when the strike price is below the current underlying price. For a put option, when the strike price is above the current underlying price.

5European Expiry Type – Options which can only be exercised on their expiry date.

6American Expiry Type – Options which can be exercised any time prior and on the expiry date.

7Margin Loan – Margin lending is a type of loan that allows you to borrow money to invest, by using your existing shares, managed funds and/or cash as security. It is a type of gearing, which is borrowing money to invest.

8Leveraging – When an investor uses borrowed funds for funding the purchase of assets in order to amplify returns, as the borrowed funds allow the investor to have greater buying power.

9Margin Call for Margin Loan– this occurs when the percentage of an investor’s equity in a margin loan falls below a required threshold set by the broker. Additional capital or securities must be added by the investor into the margin loan to bring the margin loan back to the required maintenance level.

Important Information

Neither the Commonwealth Bank of Australia nor CommSec specifically recommend the stock or strategies used in this example.

The information has been prepared without taking into account your objectives, financial situation or needs. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to their objectives, financial situation or needs, and, if necessary, seek appropriate professional advice. Investors should also obtain professional taxation advice that addresses their individual circumstances before taking out an investment loan.

You can view [the Exchange Traded Options Product Disclosure Statement and Terms and Conditions, CommSec Best Execution Statement and CommSec Financial Services Guide], and should consider them before making any decision about these products and services. There can be high levels of risk associated with trading in Options; only investors familiar with the risks of Options trading should consider these products.