What is dollar-cost averaging?

Dollar-cost averaging (DCA) harnesses the power of ‘little and often’. With this investment strategy, you invest at regular intervals, rather than investing a lump sum all at once.

Amid unpredictable market fluctuations, even experienced investors can struggle to find the perfect moment to buy in to make the most of their investment. Over time, DCA can help mitigate that risk. As some months will be better than others, it may help reduce the impact of short-term volatility on your investment.

How does dollar-cost averaging work?

How you stagger your entry in to the market is up to you. You can stagger a DCA strategy over several weeks, months, quarters, or any other way that suits your financial situation.

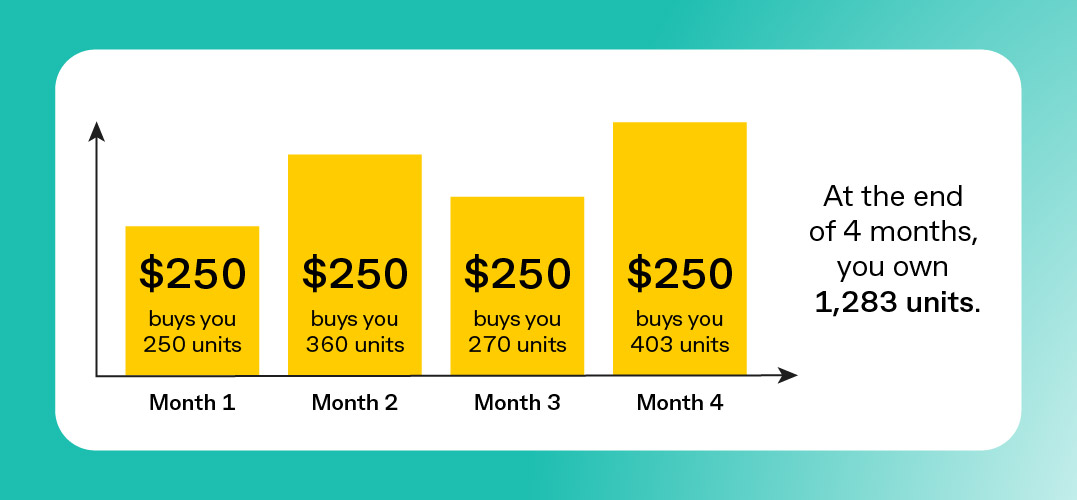

For example, if you’re looking to invest $1,000 into the share market, rather than purchasing $1,000 worth of shares at one time, you could spread your buy-ins over four months. This means you’d make a commitment to yourself to spend $250 on shares each month for the next four months, regardless of the price at each of those times.

As the market changes, your budget might buy you a different amount of shares each time. So if things go your way, you may be able to purchase more share units than if you had invested the entire lump sum in the first month. However, share prices do fluctuate, so there’s also a chance you may end up with fewer shares.

Another way to use DCA is by getting into the habit of regularly reviewing your personal budget before your next investment. For example, you could set up your account to automatically invest $100 after each payday. Before it goes through, you review your finances and tweak the investment depending on whether you have a little extra saved or are feeling a little over-stretched.

How can dollar-cost averaging pay off in the long-run?

Rather than reacting to short-term market movements and buying on a whim, a consistent DCA strategy helps spread the price risk over time. At the same time, it could help get you more bang for your buck in the long-run as share prices fluctuate day to day and month to month.

While trying to ‘time the market’ may be the strategy of choice for some, riding the sharemarket rollercoaster can be taxing – not to mention time-consuming. DCA is a great way to get an investment portfolio going. If you don’t have a large sum of money to invest upfront, it can be an effective way to break into the market while keeping an eye on your overall budget.

What are the risks of dollar-cost averaging?

If you take a ’set and forget’ approach to your investing, there’s always the risk that you may miss a chance to buy when prices are most in your favour. Similarly, some of your purchases might fall on days when prices are less ideal.

There’s also a chance that as the market grows stronger, your purchase amount doesn’t hold the same buying power so, eventually, you may not be able to acquire as many shares as you did in the beginning. Of course, there is also the risk that your investment turns out to be unsuccessful. That is, the company you chose fails to live up to expectations. As a result, the share price doesn’t rise over time or dividends fail to grow. So, whether you invest a large sum of money or spread your purchase over time, you should always review your investments and continue doing your research. If things don’t go your way, you may face the difficult decision to change your strategy.

It’s also worth considering that each investment comes with a small transaction fee. So, rather than paying a one-off fee for a larger investment, you will likely be charged each time you buy additional shares.

Getting started with your dollar-cost averaging strategy

Building your own DCA strategy starts by looking at your budget and deciding how much you’d be comfortable investing each time you buy. If you have a larger sum to spend, you simply divide it by the number of investment intervals you have set yourself.

With tools like CommSec Pocket , you can then select the shares that appeal to you and turn on automatic fortnightly or monthly investments. Ahead of each new interval, the app sends you a transaction reminder. This way, you have the opportunity to tweak your investment amount or cancel any time before your account gets debited.

What are secular trends?

What are secular investing trends, and the biggest secular trends impacting sharemarkets today.

What’s up with petrol?

What affects the price of petrol, and why does it get so much attention? Let’s look at the details.

Lessons from the dotcom

What happened during the dotcom era and is the same thing happening today? We take a closer look.

Important information

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited (formerly Chi-X Australia Pty Limited), a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.

This information is not advice and is general in nature. The information has been prepared without taking account of the objectives , financial situation or needs of any particular individual. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to the individual's objectives , financial situation or needs, and, if necessary, seek appropriate professional advice. You can view the CommSec Terms and Conditions, Product Disclosure Statements, Best Execution Statement and Financial Services Guide, and should consider them before making any decision about these products and services.

Past performance is no guarantee of future performance.