CommSec

CommSec

5 Dec 2022

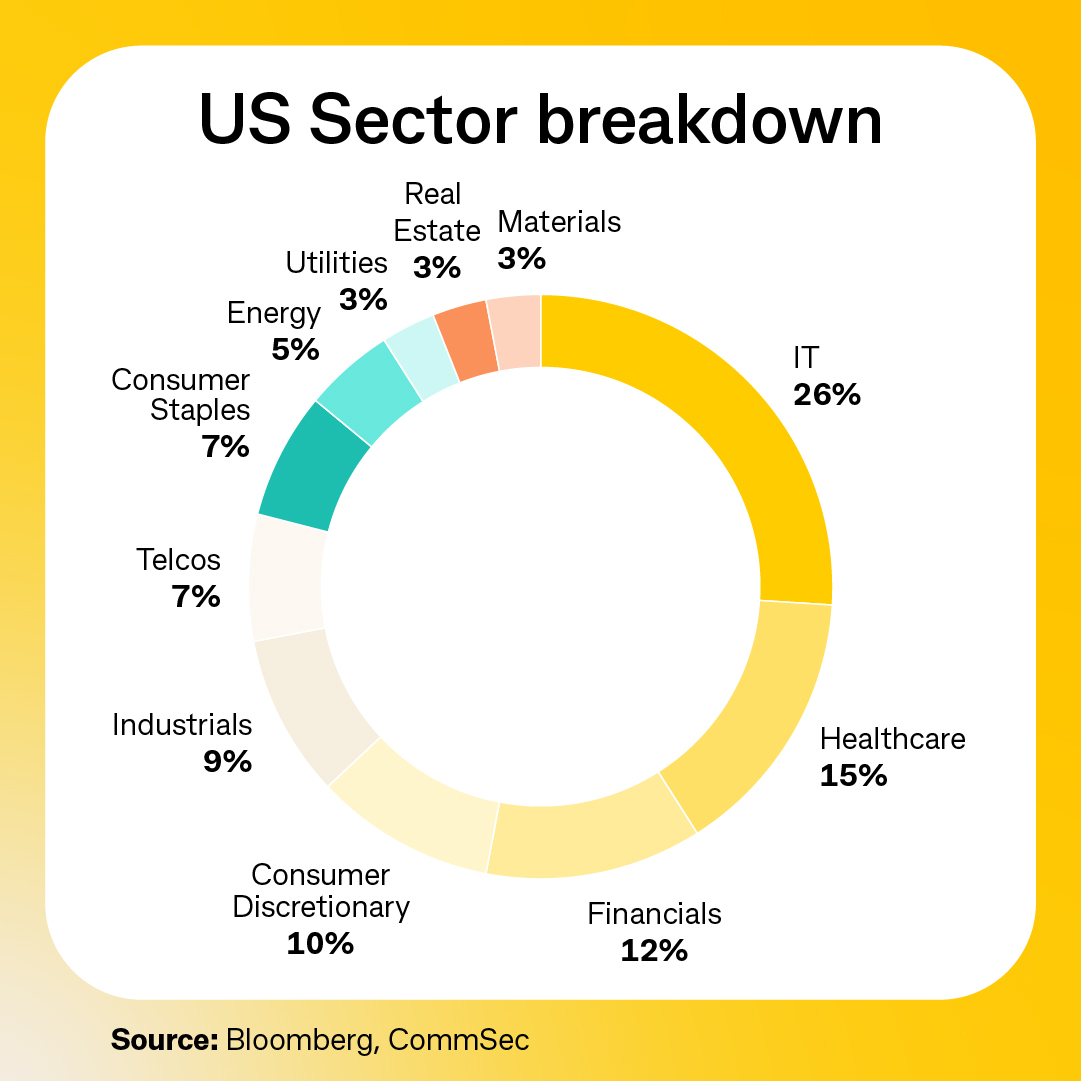

One of the most popular ways of measuring the performance of the American market is via the benchmark Standard & Poor’s (S&P) 500 index. It’s an index that tracks the performance (that is, aggregated share price movements) of the 500 largest publically traded companies in the world’s biggest economy, like technology giant Apple.

For the purposes of this article, we’ll briefly explain the sectors which make up this index.

The list of below sectors is sorted by size, from largest to smallest.

INFORMATION TECHNOLOGY

Easily the US market’s largest sector, accounting for roughly a quarter of the S&P 500 index. The index’s five largest stocks are Apple, Microsoft, chipmaker NVIDIA, Visa and Mastercard. For comparison’s sake, Apple alone has a market capitalisation (the total market value of a stock) which is roughly 35% larger than the entire Australian bourse. This highlights the breathtaking size of the industry.

Stocks in this sector are often referred to as growth stocks, meaning that they are frequently expected to grow revenues or profits at a faster pace than the broader market. They also tend to be more expensive in valuation terms. However, many businesses in the sector tend to pay investors smaller dividends, opting to spend heavily on expansion instead. Rising interest rates can also weigh on the sector as higher borrowing costs crimp their earnings growth potential. In fact, tech stocks fell most when central banks started raising rates aggressively in 2022 to slow inflation.

HEALTHCARE

The Healthcare sector is often referred to as a defensive part of the market, attracting some investors during more challenging economic times, such as the global pandemic. While people might delay a holiday, they are much less likely to put off the purchase of life-saving vaccines, doctor prescribed medications, a surgery or the purchase of protective equipment (like gloves or masks).

Some of the larger companies in the sector include UnitedHealth, a US health insurer, Johnson & Johnson, a multinational with over 100 years of experience developing medical devices, pharmaceuticals and consumer goods, together with major drug makers like Eli Lilly, AbbVie, Pfizer, Moderna, Merck & Co and Bristol-Myers Squibb. There are over 60 companies in the sector.

FINANCIALS

The sector is comprised of banks, insurers, money managers, stock exchanges, investment groups and brokers. One of the largest stocks is Berkshire Hathaway, a company led by arguably the most successful investor of all-time, Warren Buffett. Berkshire holds significant stakes in dozens of bellwethers including Apple, oil and gas giant Chevron, Coca-Cola and food group Kraft-Heinz.

Other major companies in the sector include JPMorgan Chase & Co, America’s largest bank, Wells Fargo, Bank of America, Goldman Sachs, Citigroup, insurance firm Chubb, credit rating business Moody’s and Nasdaq, which operates a major US stock exchange. Bank profit margins generally lift in a rising interest rate environment.

CONSUMER DISCRETIONARY

This sector consists of companies that sell goods or services characterised as ‘non-essential’. While some might argue that a 98 inch TV or month-long yoga retreat in Bali are necessary expenditures, most would consider these as ‘nice-to-haves’. That’s why fashion and consumer electronics retailers, hotels, department stores, cruiseliners, toy makers, home improvement chains and car manufacturers fall in this group. As a general rule, their success is closely tied with the growth phase of an economy. The more confident and prosperous consumers feel and the greater their job security, the more likely they are to spend. But retailers often discount the prices of their goods as inventories build as consumer spending eases due to an economic downturn.

Some of the larger stocks in this sector include retail giant Amazon.com, electric vehicle group Tesla, Home Depot, McDonald’s NIKE, Target, Hilton and Starbucks.

INDUSTRIALS

The sector is comprised of businesses associated with aerospace & defence like Lockheed Martin, Raytheon Technologies or Honeywell International, heavy machinery manufacturers like Caterpillar, construction & engineering firms, plane maker Boeing and more diversified companies like General Electric or 3M, which do everything from building aircraft engines, medical imaging equipment and air conditioner filters.

The sector is sensitive to the phase of an economic cycle. A slowing economy can reduce aircraft orders by airlines, delay construction plans for major building projects and limit the need for mining equipment as demand for commodities declines.

COMMUNICATION SERVICES

The sector is filled with media, entertainment and telecommunication services companies. This includes well-known global brands like Alphabet (Google), Meta Platforms (Facebook), Walt Disney, Netflix, T-Mobile and game developer Activision Blizzard. Spending on marketing and advertising alongside subscriber growth are considered key performance indicators of this sector.

CONSUMER STAPLES

Consumer staples are businesses that sell goods considered to fulfil basic consumer needs, like food, drink, toiletries and vitamins. On the US sharemarket this includes discount retailer Walmart, Proctor & Gamble (Gillette, Olay and Oral B), Coca-Cola, PepsiCo, Costco, cigarette maker Philip Morris and Colgate-Palmolive.

This sector is often considered a defensive part of the market. Consumers will continue buying food, shampoo, toothpaste, nappies and kitty litter even if an economy falls into recession. But cost of living pressures in periods of elevated inflation could affect profit margins and demand for goods offered by companies in this sector.

ENERGY

The sector is led by oil & gas producing heavyweights like Exxon Mobil, Chevron and ConocoPhillips. Profits are driven by production levels, costs and importantly commodity prices. While these businesses have some control over production and costs, they are vulnerable to movements in energy prices. Profits tend to receive a healthy boost when global supply is low and demand is high, while earnings often decline during recession.

No other global group has a greater impact on energy prices than the Organization of Petroleum Exporting Countries or OPEC. Many of the world’s largest oil producing nations are members of the cartel, accounting for roughly 40% of global output. It is in the cartel’s interest to keep prices at higher levels to benefit their 14 member states. OPEC holds a monthly meeting in Austria; often used as a platform for setting production targets. Agreements reached can affect energy prices.

UTILITIES

Utilities are companies that provide essential services like water, electricity and natural gas to customers. This is one of the smaller sectors of the US sharemarket. It’s led by NextEra Energy, which generates power through wind, solar, natural gas and nuclear sources. Duke Energy is another major utility and one of the largest power companies in the United States, serving over 8 million retail customers in six states.

The sector may be attractive to some investors seeking generally stable and consistent dividends. Utilities are sensitive to changes in regulation, prices (of electricity for example) or emerging technologies.

REAL ESTATE

The Real Estate sector contains businesses that buy or develop properties and lease/rent them out for income. The type of properties they own vary and can offer investors access to assets that would be challenging for most to purchase directly, like shopping centres, office buildings, retirement villages, warehouses and distribution centres.

The largest stock in the sector is Prologis, which has developed thousands of sites for companies like Amazon.com, FedEx, Home Depot and Walmart.

Real estate investment trusts are considered to be ‘bond proxies’ as they are interest rate sensitive. Property stocks can be attractive to investors when interest rates are low, thanks to some offering consistent dividend payments and a steady stream of income. Rising interest rates can act as a headwind for the sector, increasing borrowing costs and potentially hitting the value of their assets.

MATERIALS

The sector includes mining companies, chemicals suppliers, crop protection products and other specialty materials used in a range of markets. Freeport-McMoRan, Newmont, DuPont and Dow are some of the well-known stocks in the sector.

Broadly speaking, these stocks are most sensitive to the underlying prices of the commodities they sell together with costs associated with their production. Developments in the world’s top commodities consumer, China, generally has the biggest impact on materials sector sentiment. Geo-political risks, economic growth prospects and demand/supply of commodities are also key share price drivers of individual companies and sectors.