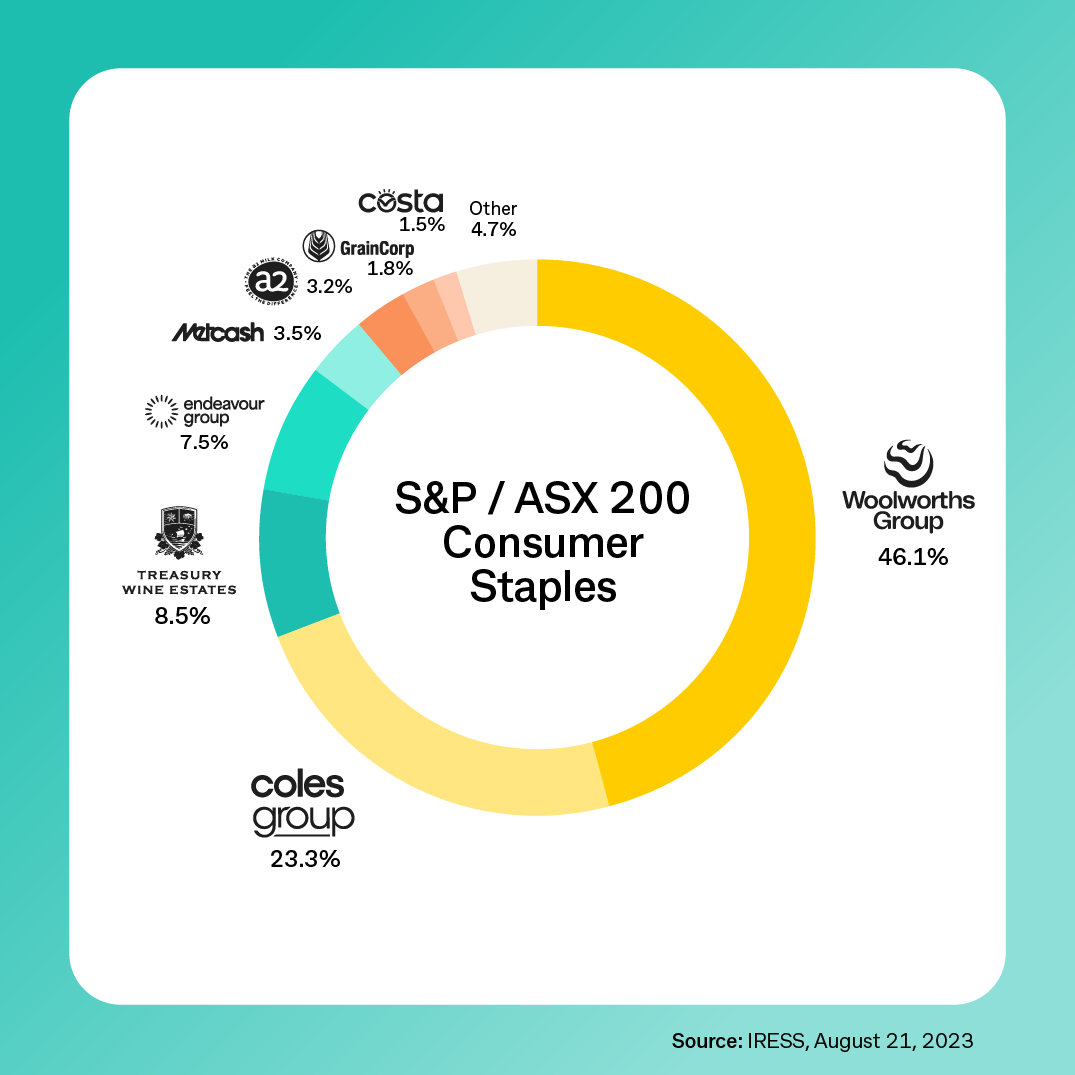

Consumer Staples is the fourth smallest of the 11 industry sectors with market capitalisation just below 5% of the S&P/ASX 200. Consumer staples is dominated by Woolworths, accounting for around 46% of the overall Consumer Staples index.

What exactly are consumer staples?

The short answer is: basically, all the stuff in your fridge, pantry and cupboards!

The slightly longer answer is that this sector contains the companies that provide goods that meet the most basic needs or are considered essential products purchased by consumers: food, alcohol, tobacco and household goods, to name a few.

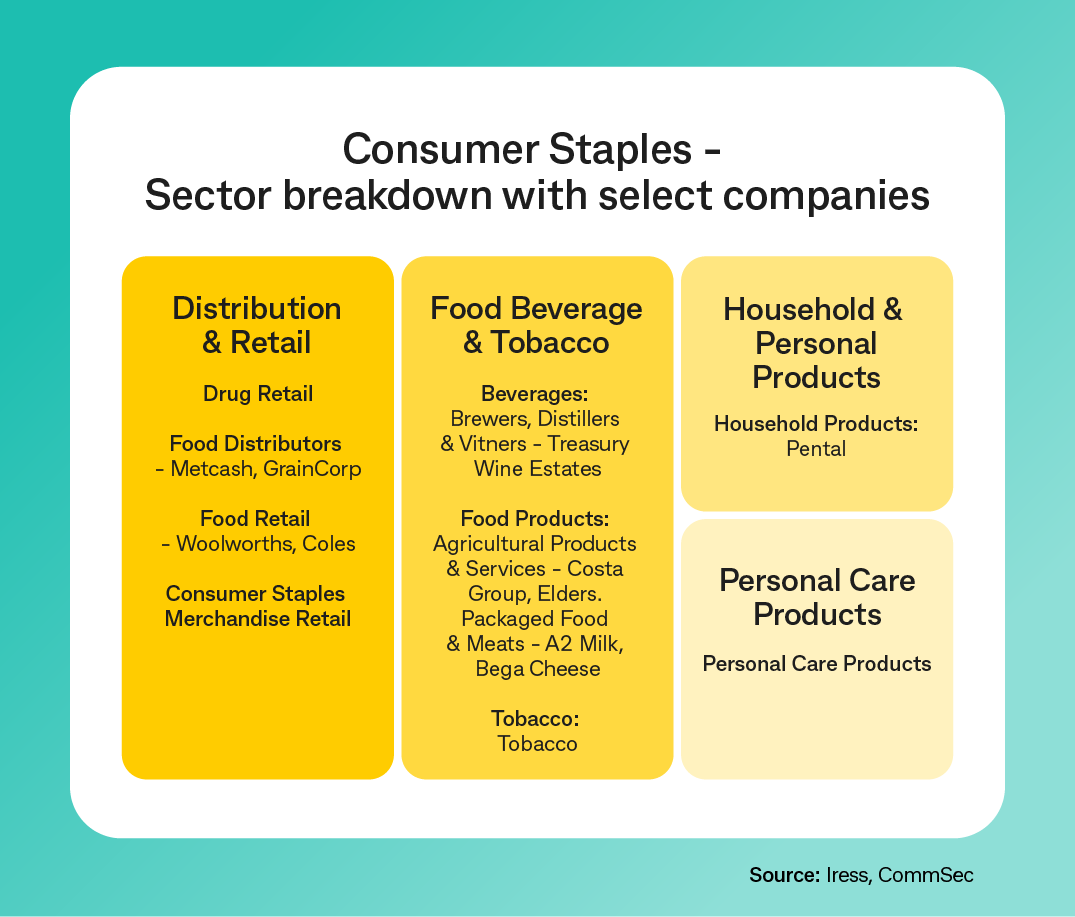

In Australia, there are around 100 companies that are defined in the broad Consumer Staples sector, including supermarket giants, Woolworths and Coles major wine producer, Treasury Wine Estates; wheat marketing company, Graincorp; food producers like Bega Cheese and Inghams; and cleaning products company, Pental.

Probably the best way to understand the Consumer Staples sector is to see how it is broken up. This is done in the table below. Clearly, the sector covers a lot of territory.

Why would you invest in Consumer Staples?

For investors, one of the most appealing aspects of Consumer Staples is that demand for the goods provided by constituent companies is relatively stable over time. People need to eat and drink and keep their homes and themselves clean, through products like Sunlight dishwasher liquid or Softly laundry detergent (both produced by Pental).

During challenging economic times, families may decide to reduce discretionary visits to restaurants and spend less on take-away burgers and pizza, instead cooking more meals at home from ingredients bought at the supermarket.

While the economy may go through cycles of growth and contraction, Consumer Staples tends to be relatively less affected by these fluctuations. And for risk-averse investors, that is a major positive.

What are the risks of investing in Consumer Staples?

That doesn’t mean to say that the sales of companies in the Consumer Staples sector don’t fluctuate with the broader economy.

Currently, with higher interest rates and the rising cost of living, the big supermarkets are reporting that people are switching away from fresh vegetables to frozen varieties. And they are also switching from prime cuts of meat to more mainstream cuts like chuck steak. All these changes in customer behaviour impacts the company’s earnings and therefore may affect its share price.

And when things in the economy do start to pick up, it’s likely investors might start to favour companies that benefit from an environment of faster economic growth, such as those in the Consumer Discretionary sector (think, household goods retailers), Materials (mining) or Information Technology (computer software, cloud services and artificial intelligence).

As is always the case, investors can get exposure to the Consumer Staples sector directly by buying shares in companies represented in the sector. But there are also a number of exchange trade funds (ETFs) that are offered.

Of course, investing in any single sector or company always carries risk, which should be assessed and weighed against your general risk tolerance and investment strategy.

How has the sector performed over time?

Over the past decade, the Consumer Staples sector of the sharemarket has under-performed the broader ASX200 index. Total returns on the Consumer Staples sector have lifted 7.8 per cent on average per annum, below the 9.1 per cent per annum lift for the ASX 200 index.

While the Consumer Staples share price index has lifted 4 per cent a year, dividends have increased on average by 3.8 per cent a year. In contrast, the ASX 200 share index has increased at a faster 4.7 per cent a year while dividend growth has averaged 4.4 per cent a year.Still, Consumer Staples was the second-best performer behind Healthcare when measuring the biggest annual drop in returns over the past decade. That is to say, while it may have performed below average from a returns point of view, the sector is less likely to record a large fall in returns in any one year, as shown by its relative resilience during COVID-19.

Final thoughts before you invest

Risk-averse investors may be attracted to Consumer Staples companies on the belief that returns will be less volatile than more growth-focussed companies and offer consistent earnings and dividends.

But in practice, the Consumer Staples sector is represented by a raft of small and larger companies. It is always important to take into account the management and strategy of the company, the industry that it operates in, presence of pricing power, financial track record as well as the current and prospective economic environment.

What are secular trends?

What are secular investing trends, and the biggest secular trends impacting sharemarkets today.

What’s up with petrol?

What affects the price of petrol, and why does it get so much attention? Let’s look at the details.

Lessons from the dotcom

What happened during the dotcom era and is the same thing happening today? We take a closer look.

Important information

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited (formerly Chi-X Australia Pty Limited), a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.

This information is not advice and is general in nature. The information has been prepared without taking account of the objectives , financial situation or needs of any particular individual. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to the individual's objectives , financial situation or needs, and, if necessary, seek appropriate professional advice. You can view the CommSec Terms and Conditions, Product Disclosure Statements, Best Execution Statement and Financial Services Guide, and should consider them before making any decision about these products and services.

Past performance is no guarantee of future performance.